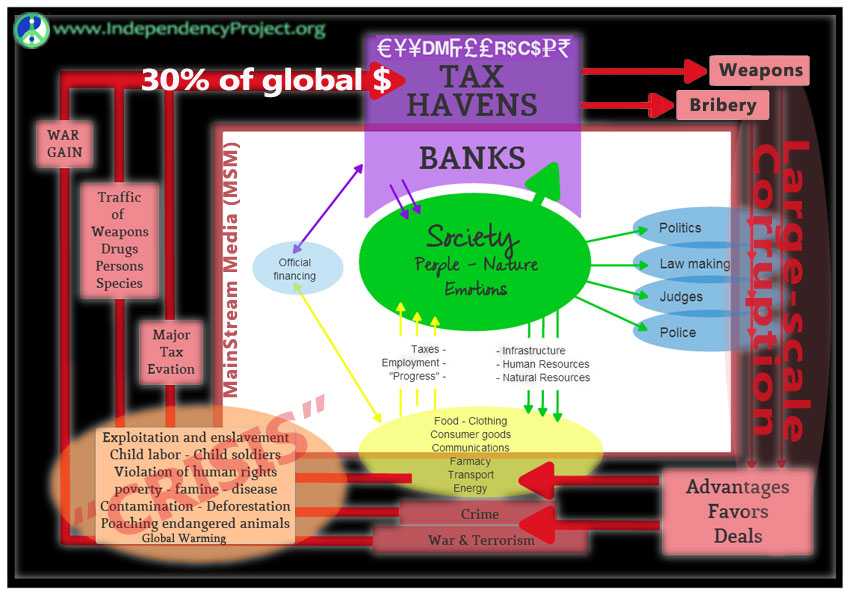

Commercial banks support Tax Havens

Major "trusted" commercial Banks help clients hide Trillions in Offshore Tax Havens

'Trusted' private banks like Barclays, UBS, Credit Suisse, JP Morgan and Goldman Sachs are the first ones to uphold the existence of the Treasure Islands. In fact, many (most, if not all) have their own subsidaries for so-called Off Shore Banking. The only function of these subsidaries is to avoid or evade taxes in the home-country of the wealthy and powerful, be it an individual or an industry (as opposed to normal citizens and small business). In a moral or ethical sense tax avoidance and tax evation are identical. The difference is only determined by the fact whether this "not-paying-fairly-due-taxes" is accomplished in a fully illegal way or in a vaguely legal way, dextrously benefitting niches in international law.

"...its a big business for US banks, as well as for UK banks and Swiss banks..."

While the so called "crisis" is still choking families to suicide, small businesses to bancruptcy and whole countries to revolution "Top US banks Goldman Sachs and JP Morgan have reported sharp rises in profits (2012) on the back of strong performance in investment banking." (GM - JPM)

Some of the banks mentioned in the following video are USB, Credit Suise, JPMorgan and Goldman Sachs. The clients are not mentioned in the video but companies like Microsoft, Apple and Google frequently appear in Main Stream Media ("Companies such as Microsoft and Apple quietly dodge billions of dollars in taxes each year with potentially illegal schemes to move their profits offshore") but it is a well known practice of nearly all known corporations that are on the stock exchange, that appear in Fortune 500 and of which we may purchase as much as 90% of all that we consume.

This website will be on the watch to compile lists of both banks and corporations that engange, not just in Tax Evasion, but any use of Treasure Islands to hide money from the rest of the world, with referrence to the source, or at least offer links to already existing lists when found.

For the moment just the list of the 50 biggest "official" BANKS in the world according to Global Finance Magazine. Remember that an estimated 25 to 30% of the money is hidden on Treasure Islands.

| Rank | Bank | Country | Total Assets ($m) | Statement Date |

| 1 | Deutsche Bank | Germany | 2,799,977 | 12/31/11 |

| 2 | HSBC | United Kingdom | 2,555,579 | 12/31/11 |

| 3 | BNP Paribas | France | 2,542,738 | 12/31/11 |

| 4 | Industrial and Commercial Bank of China | China | 2,456,287 | 12/31/11 |

| 5 | Mitsubishi UFJ Financial Group | Japan | 2,447,950 | 3/31/11 |

| 6 | Crédit Agricole | France | 2,431,796 | 12/31/11 |

| 7 | Barclays Group | United Kingdom | 2,417,327 | 12/31/11 |

| 8 | Royal Bank of Scotland | United Kingdom | 2,329,726 | 12/31/11 |

| 9 | JPMorgan Chase | United States | 2,265,792 | 12/31/11 |

| 10 | Bank of America | United States | 2,129,046 | 12/31/11 |

| 11 | China Construction Bank (CCB) | China | 1,949,213 | 12/31/11 |

| 12 | Mizuho Financial Group, Inc. | Japan | 1,890,219 | 3/31/11 |

| 13 | Bank of China | China | 1,877,514 | 12/31/11 |

| 14 | Citigroup | United States | 1,873,878 | 12/31/11 |

| 15 | Agricultural Bank of China | China | 1,853,313 | 12/31/11 |

| 16 | ING Group | Netherlands | 1,655,101 | 12/31/11 |

| 17 | Banco Santander | Spain | 1,619,259 | 12/31/11 |

| 18 | Sumitomo Mitsui Financial Group | Japan | 1,598,424 | 3/31/11 |

| 19 | Société Générale | France | 1,528,492 | 12/31/11 |

| 20 | UBS | Switzerland | 1,508,302 | 12/31/11 |

| 21 | Lloyds Banking Group | United Kingdom | 1,500,535 | 12/31/11 |

| 22 | Groupe BPCE | France | 1,472,887 | 12/31/11 |

| 23 | Wells Fargo | United States | 1,313,867 | 12/31/11 |

| 24 | UniCredit | Italy | 1,199,079 | 12/31/11 |

| 25 | Credit Suisse | Switzerland | 1,115,065 | 12/31/11 |

| 26 | China Development Bank | China | 992,158 | 12/31/11 |

| 27 | Rabobank | Netherlands | 946,649 | 12/31/11 |

| 28 | Goldman Sachs | United States | 942,140 | 12/31/11 |

| 29 | Nordea | Sweden | 926,645 | 12/31/11 |

| 30 | Norinchukin Bank* | Japan | 908,793 | 9/30/11 |

| 31 | Commerzbank AG | Germany | 856,208 | 12/31/11 |

| 32 | Intesa Sanpaolo | Italy | 827,042 | 12/31/11 |

| 33 | Royal Bank of Canada (RBC) | Canada | 797,262 | 10/31/11 |

| 34 | Banco Bilbao Vizcaya Argentaria (BBVA) | Spain | 773,305 | 12/31/11 |

| 35 | National Australia Bank | Australia | 737,243 | 9/30/11 |

| 36 | TD Bank Group | Canada | 735,947 | 10/31/11 |

| 37 | Bank of Communications | China | 731,826 | 12/31/11 |

| 38 | Commonwealth Bank of Australia | Australia | 717,245 | 6/30/11 |

| 39 | Westpac | Australia | 655,544 | 9/30/11 |

| 40 | KfW | Germany | 640,209 | 12/31/11 |

| 41 | Standard Chartered Plc | United Kingdom | 599,070 | 12/31/11 |

| 42 | Scotiabank (Bank of Nova Scotia) | Canada | 596,990 | 10/31/11 |

| 43 | Danske Bank | Denmark | 596,004 | 12/31/11 |

| 44 | ANZ Group | Australia | 581,463 | 9/30/11 |

| 45 | Dexia | Belgium | 534,039 | 12/31/11 |

| 46 | DZ Bank | Germany | 525,198 | 12/31/11 |

| 47 | Banco do Brasil S.A. | Brazil | 523,295 | 12/31/11 |

| 48 | Bank of Montreal (BMO) | Canada | 502,737 | 10/31/11 |

| 49 | Banque Fédérative du Crédit Mutuel | France | 494,501 | 12/31/11 |

| 50 | Landesbank Baden-Württemberg | Germany | 482,674 | 12/31/11 |

SOURCE: Fitch Solutions, except *Moody’s Investor Service

Read more: World's 50 biggest banks 2012 (Global Finance)

Under Creative Commons License: Attribution Share Alike

You are welcome to contribute to creating the list that links Treasure Islands, "trusted" Banks and Corporations along history (since the "invention" of Bank Secrecy in 1934) so we have at least a kind of bird view over what is actually happening with the money in this world.

Best would be to dispose of references from "official" Main Stream Media, since that is the official news "they" want or allow us to know, so the only ones trustworthy by the ruling elite standards, which is what makes it "legal" (to them) and not "some" conspiracy theory they can wave away.

Related links and references

- Log in to post comments

Español

Español Nederlands

Nederlands